Condo Insurance in and around Norcross

Townhome owners of Norcross, State Farm has you covered.

Quality coverage for your condo and belongings inside

- Georgia

- Florida

- Alabama

- South Carolina

- Tennessee

Calling All Condo Unitowners!

There is much to consider, like coverage options savings options, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a burdensome decision. Not only is the coverage remarkable, but it is also well priced. And that's not all! The coverage can help provide protection for your unit and also your personal property inside, including things like bedroom sets, pictures and appliances.

Townhome owners of Norcross, State Farm has you covered.

Quality coverage for your condo and belongings inside

Condo Coverage Options To Fit Your Needs

Everyone knows having condominium unitowners insurance is essential in case of a fire, blizzard or windstorm. Sufficient condo unitowners insurance ensures that your condo can be rebuilt, so you aren’t left with the bill for a home you can’t stay in. Another helpful thing about condo unitowners insurance is that it also covers you in certain legal cases. If someone has an accident because of negligence on your part, you could be on the hook for their hospital bills or physical therapy. With good condo coverage, you have liability protection in the event of a covered claim.

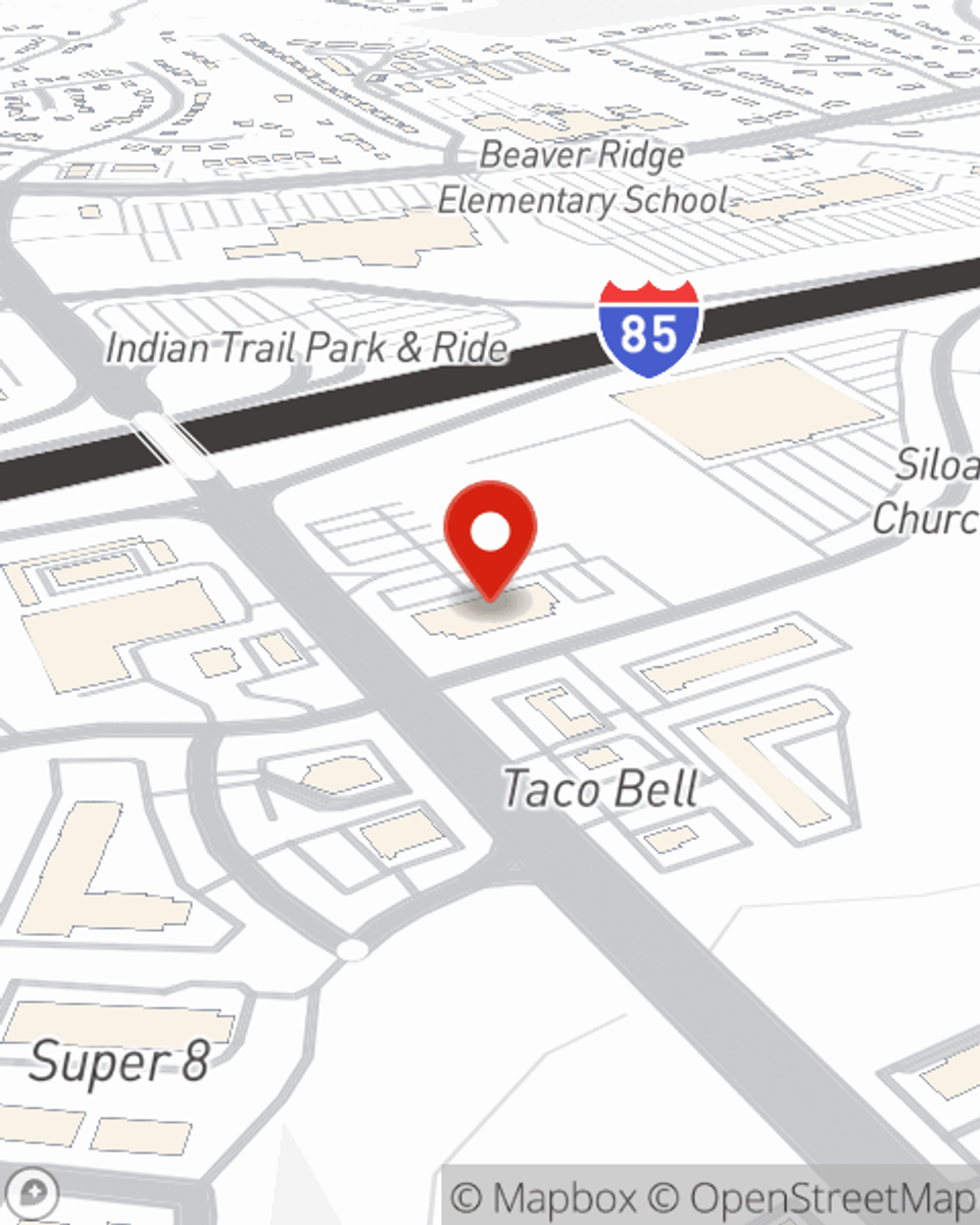

There is no better time than the present to visit agent Dan Barracliff and explore your condo unitowners insurance options. Dan Barracliff would love to help you choose the right level of coverage.

Have More Questions About Condo Unitowners Insurance?

Call Dan at (770) 921-5040 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Dan Barracliff

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.